01 September 2025

The Australian Taxation Office (ATO) has recently highlighted its ongoing focus on ensuring workers are correctly classified as either employees or contractors.

The ATO has warned that businesses who incorrectly treat employees as contractors risk significant penalties and charges under superannuation and PAYG withholding provisions and are soliciting anonymous tip-offs of non-compliant businesses.

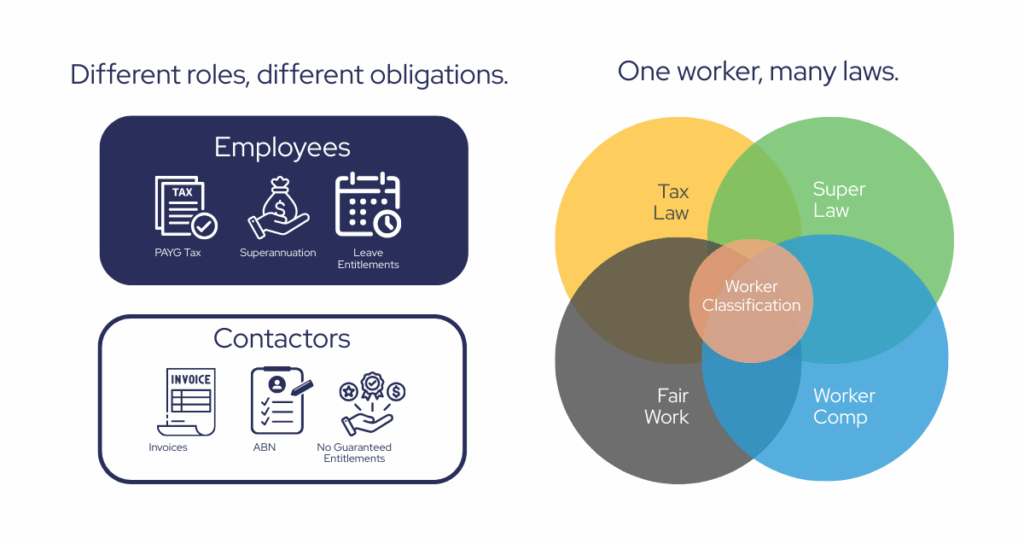

Correctly identifying whether a worker is an employee or a contractor affects:

- PAYG withholding;

- Superannuation contributions;

- Fair Work/Award compliance;

- Payroll tax; and

- Workers compensation insurance.

While many businesses engage contractors in good faith, the ATO notes that labels alone don’t determine status. What matters is the substance of the contractual arrangements.

Taxation Ruling TR 2023/4 contains guidance on how to determine whether a worker is an employee (as opposed to a contractor), which involves an objective assessment of the contractual arrangements between the parties.

This ruling is supported by Practical Compliance Guideline PCG 2023/2 which sets out the ATO’s compliance approach.

Whilst this ATO guidance is useful, worker classification remains a complex and challenging area for business. This difficulty is compounded by overlapping definitions, inconsistencies across different laws and variations between states.

For example, a worker may be correctly classified as a contractor, but the extended definition of employee in Section 12(3) of the Superannuation Guarantee (Administration) Act 1992 may still apply giving rise to superannuation obligations.

Similarly, Payroll Tax obligations may apply under ‘relevant contract’ provisions and state-based workers compensation schemes can apply to contractors even when they operate through a trust or company structure.

In light of this, businesses that engage contractors should take proactive steps to ensure that they are managing their contractor arrangements compliantly.

If you’d like help reviewing your contractor arrangements or understanding your obligations, please get in touch.