01 September 2025

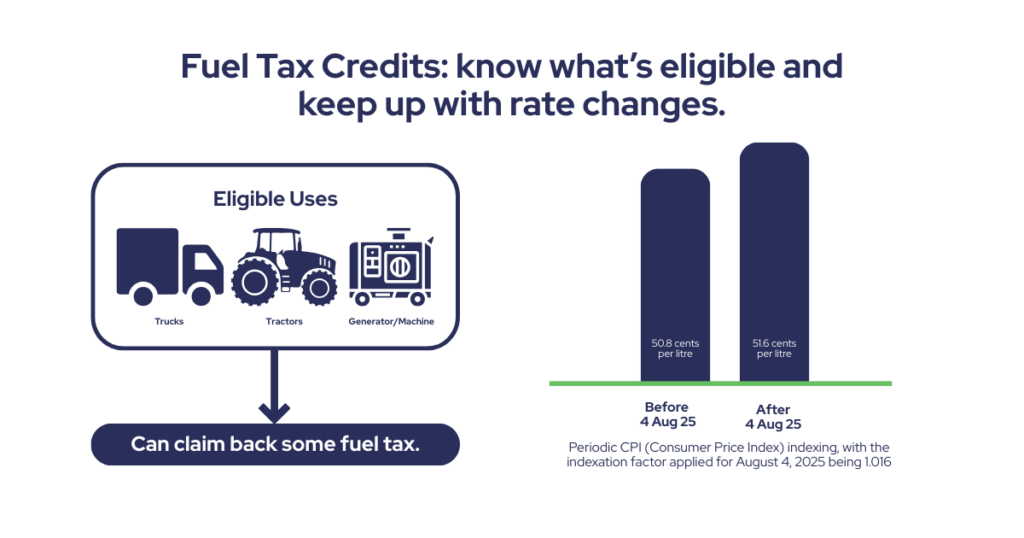

Businesses that acquire fuel for use in machinery, plant, equipment, heavy vehicles, and other business-related activities may be eligible to claim Fuel Tax Credits, for the tax included in the price of that fuel.

The ATO’s Eligibility Tool is a good resource for businesses to help determine if they are eligible to claim Fuel Tax Credits.

Fuel Tax Credit rates change regularly and the ATO have recently published the new rates applicable from 4 August 2025.

Businesses that participate in the scheme should regularly check for updates to ensure that they are basing their claims on the correct rates.

If you need assistance to determine eligibility, or the calculate your claims, please get in touch