01 September 2025

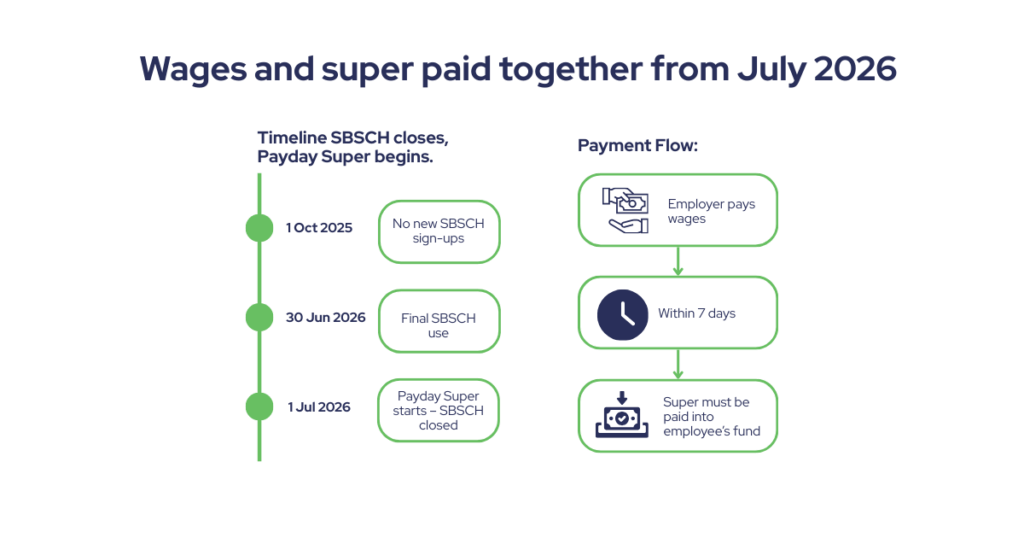

The Federal Government’s Payday Super reforms are scheduled to commence on 1 July 2026, requiring employers to pay superannuation contributions within seven days of paying wages.

Earlier this year, exposure draft legislation was released for consultation. However, with the start date fast approaching, no Bill has been introduced to Parliament, leaving employers uncertain about both the final form of the legislation and its commencement time.

In parallel, the ATO has announced the closure of the Small Business Superannuation Clearing House (SBSCH) as part of the reform. Key dates include:

- 1 October 2025 – New registrations for SBSCH will close.

- 30 June 2026 – Final date for existing users to access the service.

- 1 July 2026 – SBSCH will be permanently closed.

Despite the legislative uncertainty, businesses should begin preparing now. The shift to Payday Super will require:

- Updating payroll and superannuation processes; and

- Reviewing cash flow planning.

Also, those businesses who currently use the SBSCH will need to transition to an alternative clearing house solution.

We will continue to monitor developments and keep you informed as more details emerge.

In the meantime, if you’d like assistance understanding the impact of Payday Super on your business or preparing for the transition, please get in touch.