01 October 2025

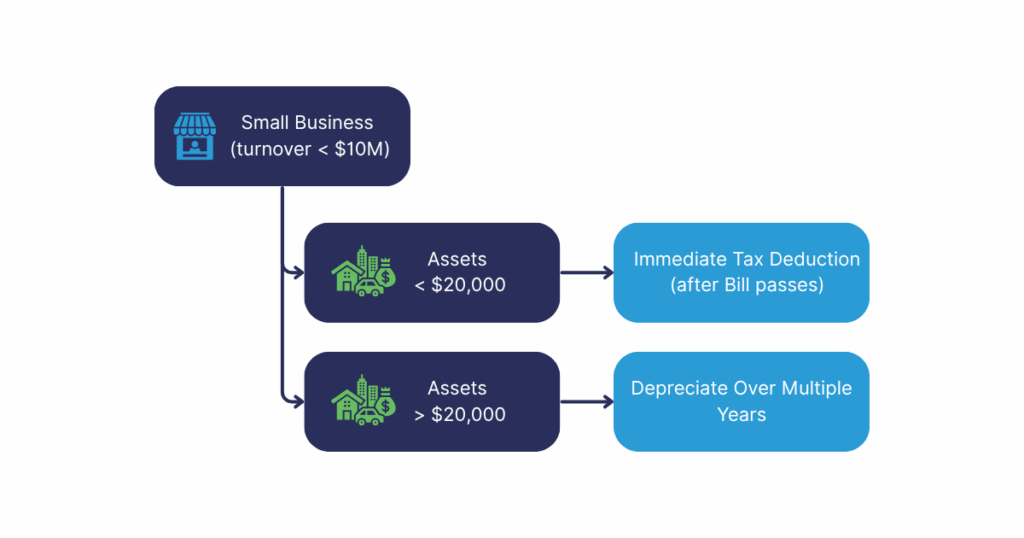

Under Section 328-180 of the Income Tax Assessment Act 1997, a Small Business Entity (turnover < $10M) can claim an immediate tax deduction for assets costing less than $1,000. All other assets must be depreciated over multiple years.

For the better part of the last decade, successive governments have increased this threshold on a year-by-year basis to encourage smaller businesses to invest in assets and to cut through the red tape of complying with depreciation rules.

In the March 2025 Federal Budget, the Labour government once again announced an intention to extend the threshold to $20,000 for the financial year ending 30 June 2026.

On 4 September 2025, Treasury Laws Amendment (Strengthening Financial Systems and Other Measures) Bill 2025 was introduced to Parliament to give effect to this increase.

It’s important to note that the $20,000 threshold does not apply until the Bill is passed. In recent years, enabling legislation has been slow to move through Parliament, undermining the very purpose of the measure.

We hope that Parliament acts more swiftly this time round.

We will continue to monitor progress and provide updates as the Bill moves through Parliament.

In the meantime, please get in touch if you’d like to better understand how the instant asset write-off might benefit your business.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom:

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.