3 December 2025

Many businesses provide Christmas functions, team events and staff gifts at this time of year.

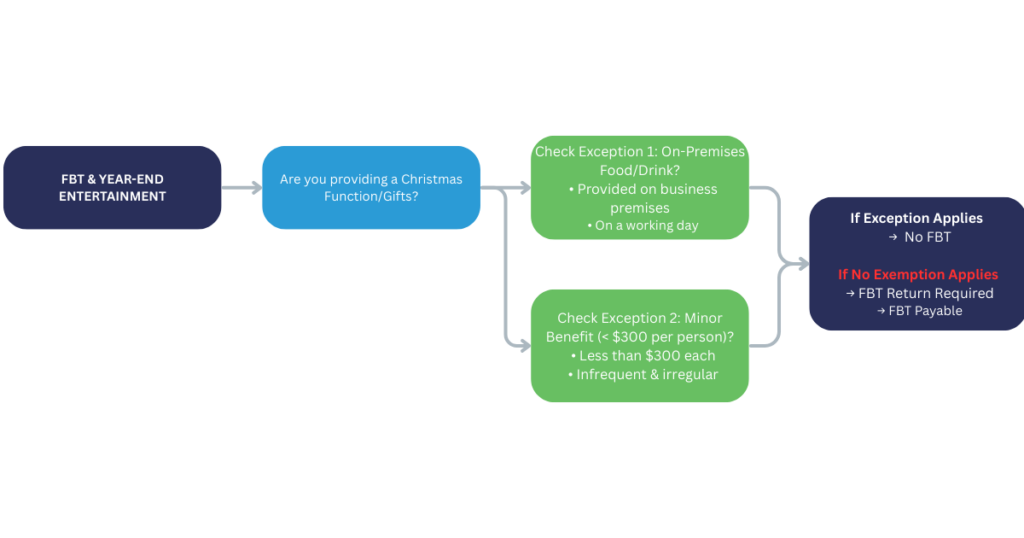

Whilst these are customary activities, they do give rise to Fringe Benefits Tax (FBT) considerations.

FBT generally arises when employers provide non-salary benefits to employees or their associates, and entertainment is a common form of fringe benefit.

While entertainment and related year-end benefits are fringe benefits, there are some instances where no FBT obligation will arise. Most notably, when:

· Food or drink is provided to employees on business premises on a working day; and

· Benefits valued at less than $300 per person are provided that satisfy the Minor Benefits Exemption requirements.

These exemptions can be highly effective, but each has nuances and complexities that need to be navigated. There are also record keeping considerations to enable a business to back-up their position in the event of an audit.

If there is no exemption that can be applied, an obligation to lodge a Fringe Benefits Tax Return will arise and there will be FBT payable. If that is the case, consideration of the different calculation methods is needed in order to achieve the best outcomes.

If you need assistance to assess the FBT implications of your end-of-year event, please get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.