Sky Update – November 2019

Taxing Christmas Parties With Christmas just around the corner, many businesses are organising their end of year Christmas party. It is important to be mindful of the tax implications

Taxing Christmas Parties With Christmas just around the corner, many businesses are organising their end of year Christmas party. It is important to be mindful of the tax implications

Gaming Machine Entitlements Not Tax Deductible The High Court has handed down its decision in the Sharpcan Case as to whether payments to the Victorian Government to

Businesses look to accounting firms for advice on becoming more efficient and cutting costs in today’s increasingly competitive business environment. Fortunately, accountants have further incorporated

Domestic overnight travel continues to perform well in Australia with about $74.5 billion spent during the year ending March 2019. The number of domestic overnight

Australia’s economy is slowing down partly because of stagnant wages growth. However, according to small business owners, workers are not the only ones who are

Owning and running a restaurant requires hard work but many still dream of opening a second venue or more. However, in today’s volatile market, would

Many commercial kitchen equipment items are now available on the market, all promising to make everything efficient and consistent. However, they come with a hefty

Business accountants take on a variety of roles in businesses in the public, private and not-for-profit sectors and even the academe. The importance of accountants in ensuring the quality of

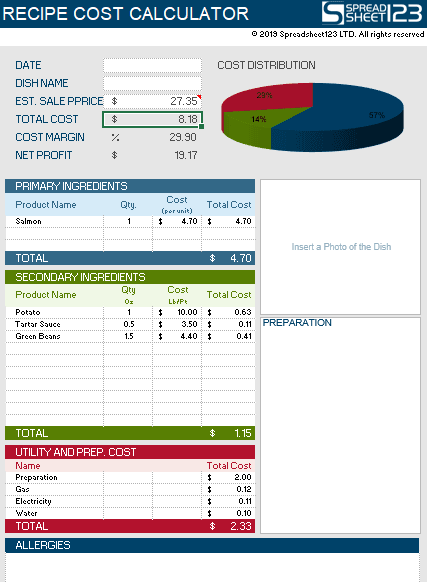

If you are running a hospitality business, this Recipe Cost Calculator will help you find out how much it costs to prepare a dish. It can calculate

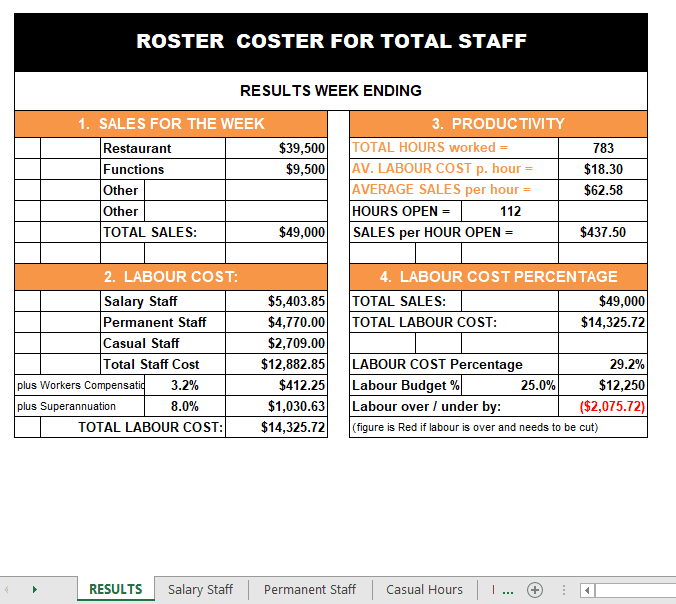

Wages are often one of the largest expenses in any business, therefore it is crucial that wages are benchmarked, controlled and monitored through restaurant and cafe bookkeeping. Without controls, without