SKY UPDATE | ‘TIS THE SEASON

As we draw near to the end of another year we are beginning to make arrangements for our annual closure. This year we will be

As we draw near to the end of another year we are beginning to make arrangements for our annual closure. This year we will be

The Board of the RBA met on the 7th of November and made a decision to increase the cash target rate by 25 points to 4.35%.

In October, we wrote about the Bendel case in the Administrative Appeals Tribunal (AAT) concerning whether unpaid distributions of income from a trust are a ‘loan’

We recently wrote about the 2022 Federal Budget announcement that will require not-for-profit entities that self-assess an income tax exempt, to lodge an annual ‘NFP self-review return’

On the 9th of November, the ATO published statistics on their activities around employer superannuation guarantee compliance. Whilst employers are paying more than 94% of the super contributions

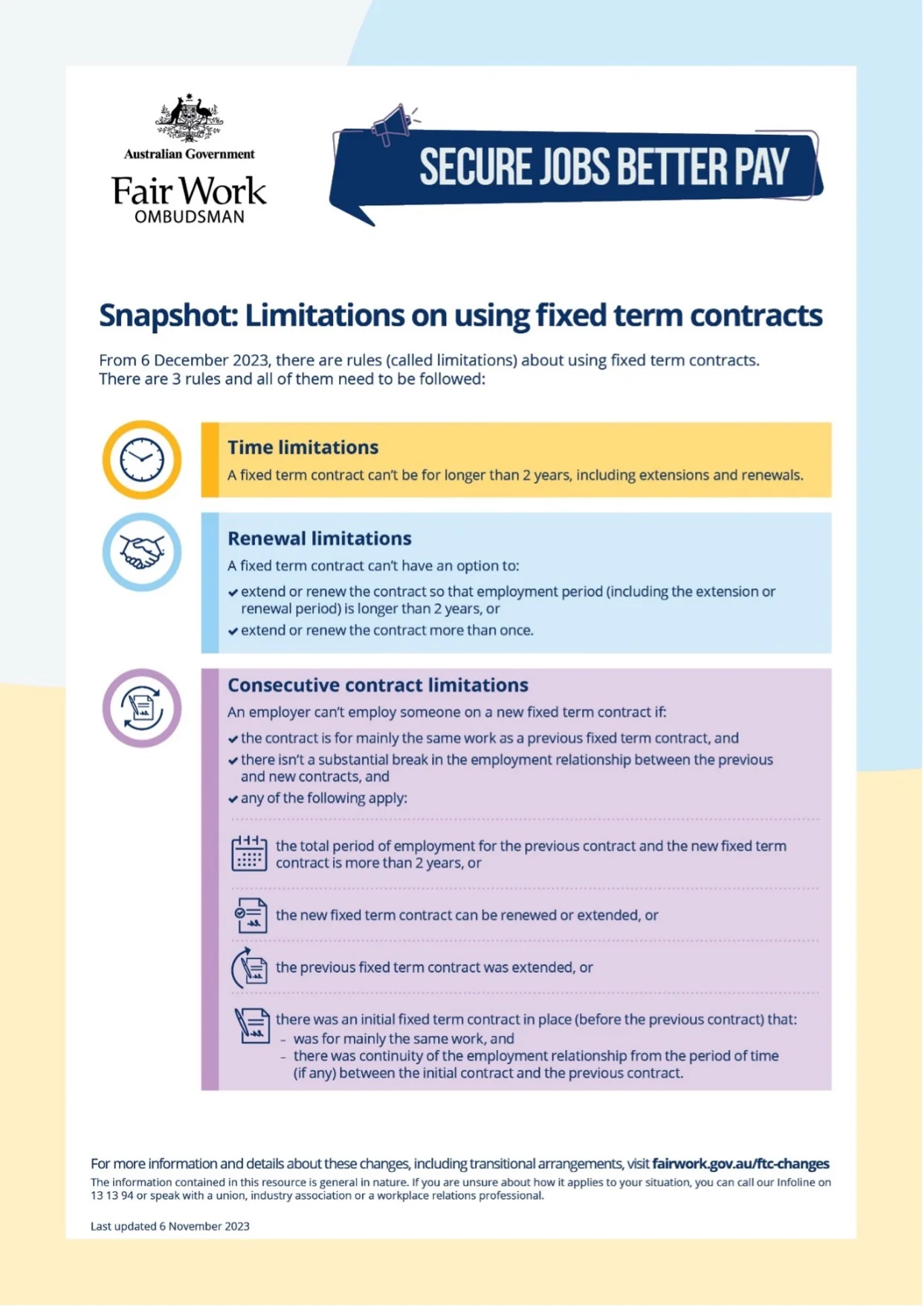

Back in January we wrote about a number of Fair Work Act changes that are progressively being rolled out. One of the items we wrote about was

On the 5th of December the RBA Board decided to leave the cash target rate unchanged at 4.35% In the statement by RBA Governor, Michele Bullock it was

The R&D Tax Incentive offers significant benefits to innovative companies, both big & small. The due date to register eligible R&D with AusIndustry is four

In the 2018 Federal Budget, the then Morrison Government announced a 3 stage programme of changes to personal taxation. Stage 1 and Stage 2 have

Last year, we wrote about the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023 which was introduced to Parliament on the 4th of September. The Bill sought to make