01 October 2025

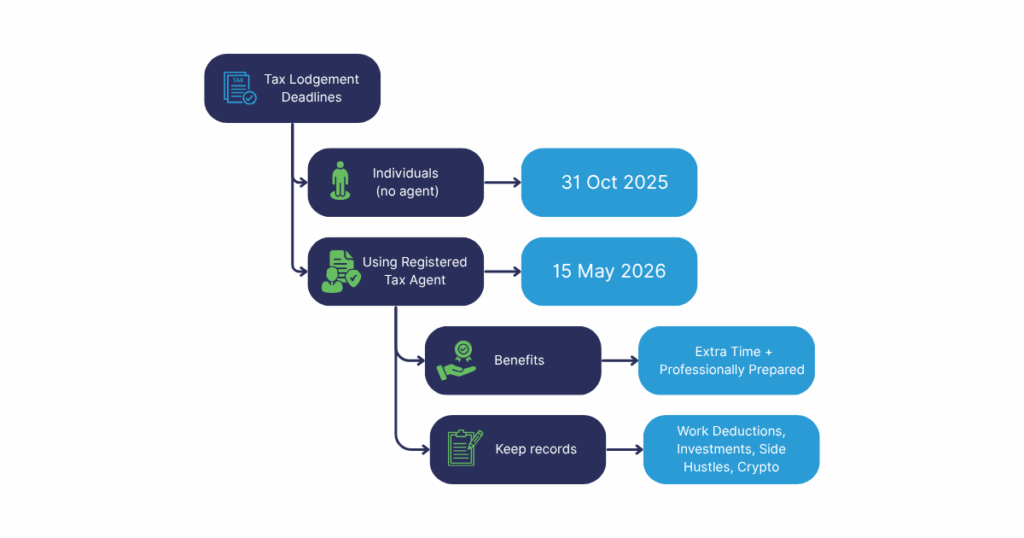

Each year in October, the ATO publicise the impending 31 October tax lodgement due date.

Whilst we applaud the ATO for being proactive, we wish they would communicate with more precision and clarity.

As the ATO’s current statistics reflect, over 40% of tax returns are lodged via registered tax agents. Accountants like Sky Accountants.

Importantly, when a person uses a tax agent, the 31 October deadline generally does not apply. Instead the Registered Agent Lodgement Program applies.

For most individuals using a registered tax agent, this means that the lodgement deadline is 15 May 2026. The payment due date for any tax owing is also deferred.

This is one of the benefits of using a registered tax agent: more time to lodge and pay plus the confidence that your return is professionally prepared.

This is particularly important given the ATOs ever increasing focus on personal tax return compliance.

Like in prior years, the ATO are continuing to scrutinise high numbers of work-related deduction claims and are having allot of success due to a combination of inadequate record keeping and misunderstandings about what qualifies for a deduction.

Additionally, the ATO continue to focus on investment property reporting, particularly those on the short-stay market and under reporting of income from side hustles in the gig economy and investments, including crypto currency and other digital assets.

The message from the ATO is loud and clear: keep good records and swim between the flags to avoid unwanted scrutiny.

If you need assistance to prepare your tax return, or advice on tax rules and record keeping requirements, get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.