01 November 2025

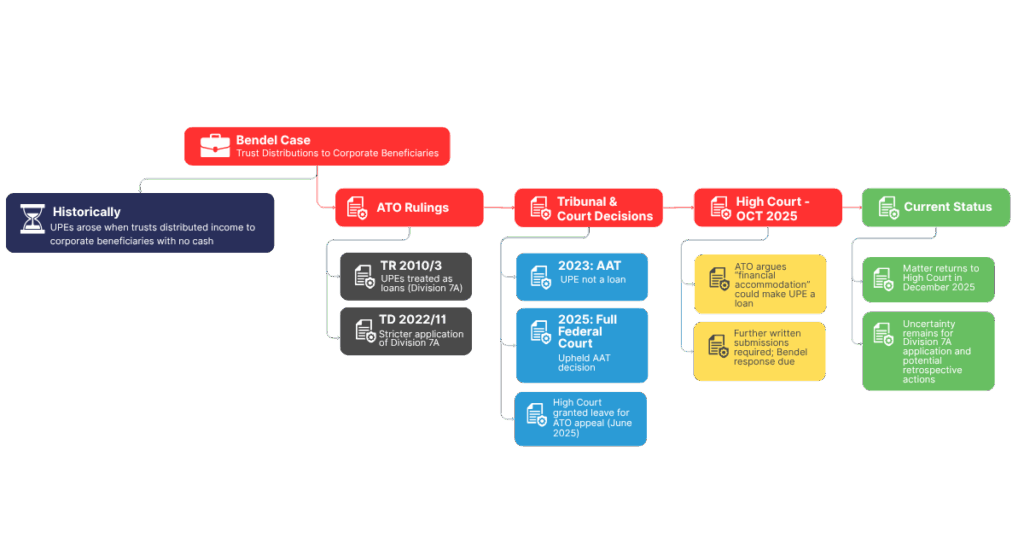

It has historically been commonplace for discretionary trusts to make distributions of income to a corporate beneficiary where no cash changes hands. This arrangement results in an ‘unpaid present entitlement’ arising.

Way back In 2010, the ATO issued Taxation Ruling TR 2010/3 , declaring that UPEs would constitute loans for Division 7A purposes. That interpretation changed the landscape for trustees overnight and has imposed additional compliance and taxation burdens ever since.

In 2022, the ATO withdrew TR 2010/3 and replaced it with Taxation Determination TD 2022/11, which went even further, applying a stricter view of how Division 7A applies to UPEs.

However, in September 2023, the Administrative Appeals Tribunal (AAT) handed-down their decision in Bendel and Commissioner of Taxation (Taxation) [2023] AATA 3074 (28 September 2023).

The AAT found contrary to the ATO’s view, that a UPE is not a loan under section 109D(3) of Division 7A. The ATO didn’t like that outcome and appealed to the Full Federal Court who in February 2025 handed down judgement in Commissioner of Taxation v Bendel [2025] FCAFC 15 (19 February 2025) upholding the earlier AAT decision.

This led to the ATO seeking special leave to appeal to the High Court, which was granted in June 2025.

The matter was heard in the High Court on 14 October 2025. During the hearing, the ATO argued that where a corporate beneficiary allows a trust to retain and use funds, that could constitute ‘financial accommodation’ such that it would be regarded as a loan under Division 7A.

This particular argument had not been dealt with in the ATO’s written submissions prior to the hearing. Consequently, a direction was made requiring the ATO to file further written submissions within two weeks.

Bendel will then have a further two weeks to respond to those submissions before the matter returns to the High Court in the December sittings.

The upshot of all of this is that there remains considerable uncertainty as to how Division 7A should be applied to UPEs and whether retrospective actions may be required.

We will continue to closely monitor the case for developments. In the meantime, if you have questions regarding the application of Division 7A to your trust arrangements and how to maximise your position, please get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.