3 December 2025

As we head into December, many businesses will be planning an annual closure over the Christmas/New Year period.

For many, it’s a practical time to take a well-earned break and reset for the year ahead.

However, a shutdown is not simply a matter of choosing dates and notifying staff. There are specific rules around directing employees to take annual leave, and these rules are often misunderstood.

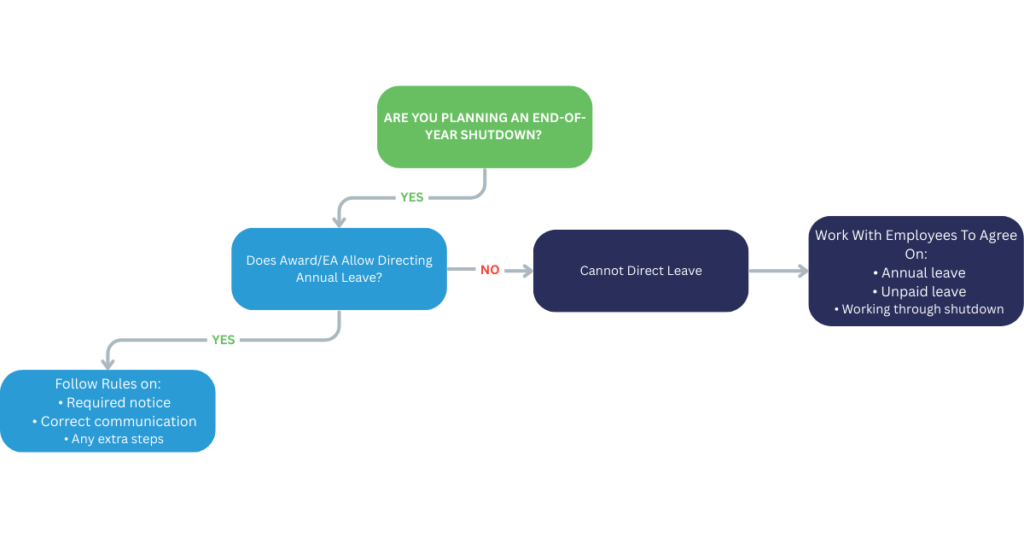

Importantly, an employer may only direct an employee to take annual leave during a shutdown if the relevant Award or Enterprise Agreement (EA) expressly allows it.

If no award or enterprise agreement applies, the Fair Work Act governs the situation. In that case, annual leave can only be taken by mutual agreement. The employer has no authority to unilaterally require employees to use their annual leave.

Where an award or EA does permit a direction to take leave, employers must follow the relevant requirements – notice periods, the method of communication and any other procedural steps.

Missing these steps can expose the business to avoidable risk.

Where no entitlement exists, employers will need to work directly with staff to put arrangements in place. This may involve agreeing to use annual leave or, where appropriate, agreeing to unpaid leave for the shutdown period.

It may also involve making arrangements for employees who do not wish to take leave and prefer to work through the shutdown period.

Further guidance on the requirements and rules is available from the Fair Work Ombudsman.

If you are planning for a Christmas/New Year shut down and need assistance to understand the requirements applicable to your business, get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.