01 November 2025

On 9 October 2025, the Federal Government introduced the Treasury Laws Amendment (Payday Superannuation) Bill 2025 into the House of Representatives.

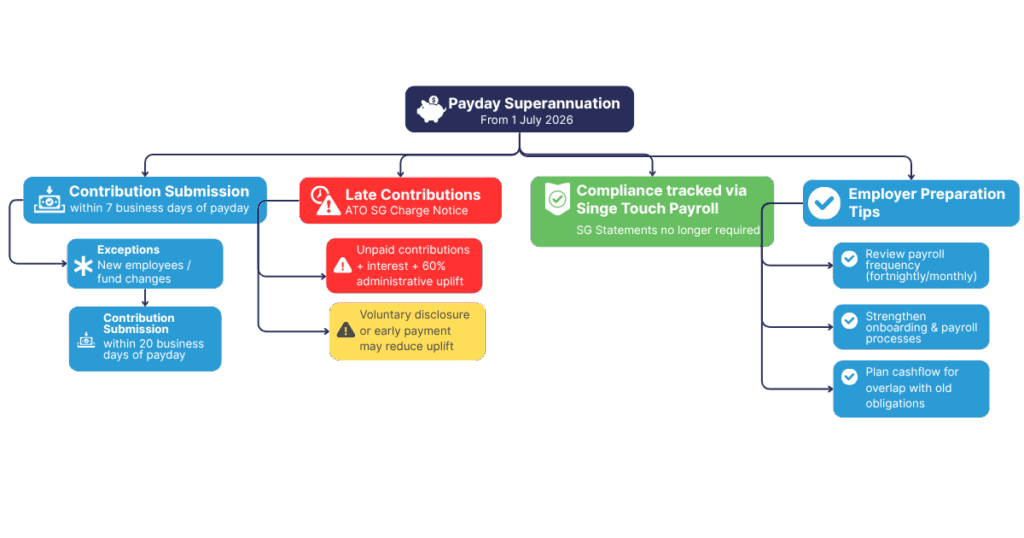

With the new law slated to commence on 1 July 2026, both the ATO and employers will have their work cut out preparing for the transition.

Under the new rules, superannuation contributions must be received by employees’ funds within seven business days of payday.

There are limited exceptions, for instance new employees or those switching funds, where the timeframe extends to 20 business days.

In practical terms, contributions will need to be processed by about day four to account for clearing house processing times.

Where contributions are paid late, the ATO will raise a Superannuation Guarantee (SG) Charge Notice of Assessment. This will include the unpaid contributions plus a ‘notional earnings’ component (interest on the late contributions) and an ‘administrative uplift amount’ equal to 60% of the contribution shortfall.

The ATO will use Single Touch Payroll (STP) and super fund reporting to identify missed or late contributions. Employers will no longer need to lodge SG statements but may make voluntary disclosures before an assessment is issued.

Paying late contributions prior to the ATO raising a SG Charge Notice of Assessment will reduce both the notional earnings component and the administrative uplift amount. Similarly, making a voluntary disclosure may result in a reduction of the administrative uplift amount.

Once an SG Notice of Assessment is raised, employers have 28 days to pay before a 25% penalty applies. If a penalty has been applied in the 24 months prior, the penalty is increased to 50%. The ATO will have no discretion to remit these penalties.

Unlike under the current SG rules, both late super contributions and SG charge amounts will be tax deductible.

In the lead-up to commencement of the payday super rules, employers should:

- Review their payroll frequency and consider fortnightly or monthly cycles where permitted as lengthening pay-cycles may produce both a cashflow advantage and reduce the compliance burden.

- Ensure that they have a reliable clearing house solution in place, noting that the ATO Small Business Super Clearing House will soon close.

- Strengthen onboarding and payroll systems and processes.

- Plan cashflow carefully for July 2026, as there will be overlap between old and new obligations.

In response to the introduction of the Payday Super Bill, the ATO has released draft Practical Compliance Guideline PCG 2025/D5 outlining their first-year compliance approach.

As you would expect, the focus will be on high-risk areas. However, it must be noted that the ATO have limited discretion in applying the new law even when there has been best endeavours to comply.

We will continue to monitor the Bill’s progress and will provide updates. In the meantime, if you’d like to understand how Payday Super may affect your business, get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.