01 October 2025

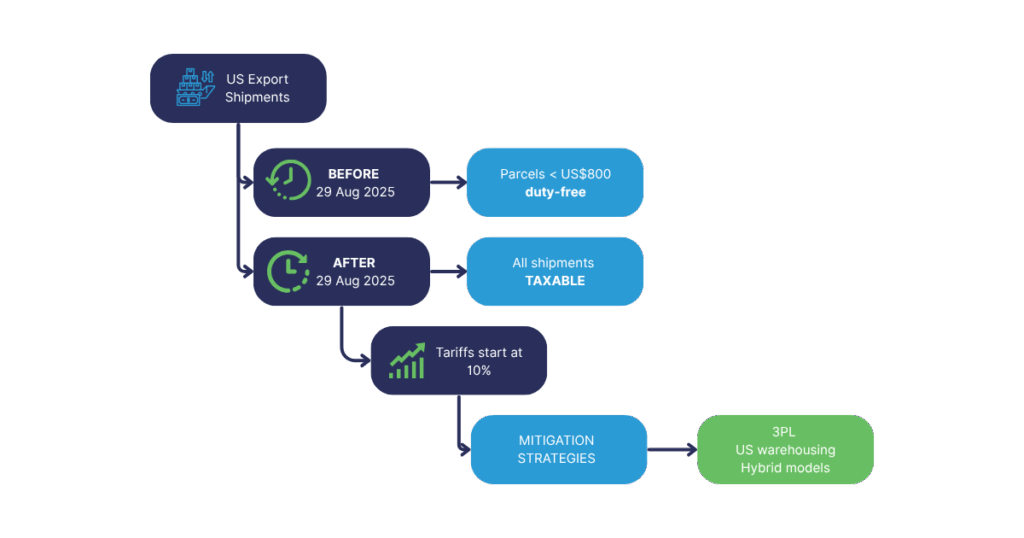

Before 29 August 2025, parcels under US$800 could enter the U.S. duty-free under the “de minimis” exemption.

That changed on 29 August 2025, when the U.S. suspended the exemption, meaning all shipments are now taxable and require full customs processing.

The suspension caused major disruption with carriers, including Australia Post, needing to pause services to build new compliant systems.

Although Australia Post and other carriers have now resumed U.S. deliveries, exporters are still trying to assess what the removal of the de minimis means for their business.

With tariffs starting at 10%, exporters must reconsider how viable U.S. sales remain. Many are exploring third-party logistics (3PL) options, U.S. warehousing, or hybrid models to mitigate the impact of the change.

Australian businesses have long worked hard to crack the U.S. market. While that market is still open, the added costs and compliance mean many are now questioning whether to shift focus elsewhere.

Guidance has been published on the Australian Governments business.gov.au website to help businesses navigate the changes.

If you need help to assess the impact of these changes on your business, please get in touch.

PS: Whenever you are ready, here are four ways we can help you grow your business and achieve financial freedom

1️⃣ Super Review – Make sure your Super is taking care of the future you → Book here.

2️⃣ Finance Check – See if refinancing could save you money → Book here.

3️⃣ Business Coaching – Ready to scale? Let’s map your next moves → Book here.

4️⃣ Work privately with us – Tricky tax situation? Looking to buy/sell? Need high level advice? → Book here.